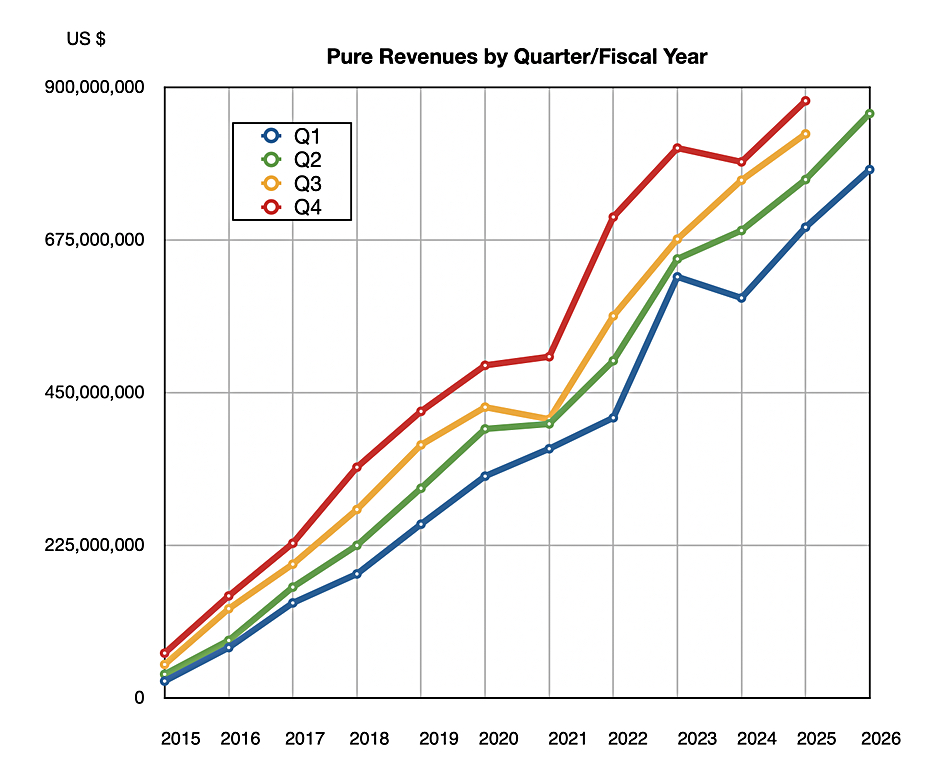

Pure Storage knocked its revenue ball out of the quarterly results park, beating its guidance and upping its full year expectation.

Revenues in its second fy2026 quarter, ended August 3, increased 13 percent year-on-year to $861 million with GAAP net income of $47 million, up 31 percent Y/Y. Product sales amounted to $446.3 million, up 23.6 percent. Subscription annual recurring revenue (ARR) rose 18 percent to $1.8 billion and some 300 new customers were signed, with the total customer count above 13,500 and heading towards 14,000. Storage-as-a-Service revenues increased 24 percent Y/Y to $125 million, driven by high-volume, high-velocity transactions of less than $5 million.

CFO Tarek Robbiati stated: “Pure Storage exceeded both its revenue and operating profit guidance in the second quarter, reflecting strong customer adoption of our platform strategy.” He added: “We saw broad-based strength across our entire portfolio, led by large enterprises and the continued momentum of FlashBlade, including FlashBlade//E, and accelerating momentum in our core software and services offerings of Evergreen//One, Cloud Block Store and Portworx.”

Financial summary:

- Gross margin: 70.2 percent, down from 70.7 percent a year ago

- Free cash flow: $150.1 million vs $166.6 million a year ago

- Operating cash flow: $212.2 million vs $226 million a year ago

- Total cash, cash equivalents, and marketable securities: $1.5 billion vs $1.82 billion a year ago

- Remaining Performance Obligations: $2.8 billion, up 22 percent year-on-year

The only reddish flags in the financial summary are the downturns in the operating and free cash flow numbers, but Pure’s past results show a Q2 seasonal dip in these cash flow numbers, so the concern about this reddish shift can go away. Robbiati said: “Capital investments of $62 million included test and infrastructure equipment to support data center expansion and funding of Evergreen//One subscription growth.”

CEO and chairman Charles Giancarlo stated: “Our strategic co-engineering effort with Meta continues on track. They have initiated their first volume deployment, and we have recognized our first revenue from this activity in Q2. … Overall, our early-stage engagements with other top hyperscalers continue to progress well, as hyperscalers in general are increasingly seeking to accelerate their transition to flash data storage.”

Robbiati added some color to the Meta business: “Our collaboration with Meta continues well and as expected. As a reminder, our original FY26 guidance assumed deployment of 1 to 2 exabytes of our DirectFlash technology. Deployments have started, such that we have begun to recognize revenue this past quarter. Given the pace of these deployments, we are now increasingly confident about the assumption of 1 to 2 exabytes, and possibly more, by our FY end.” The Meta deal generates Direct Flash Module (DFM) licence (royalty) revenue as Meta is sourcing its own hardware. Possibly double-digit exabytes could be involved in Pure’s cy2026.

The Meta deal has excited interest in other hyperscalers about Pure’s better-than-commercial-SSDs DFM technology. CTO Rob Lee said in the earnings call that the Meta deal: “has accelerated our engagements with both other hyperscaler prospects as well as suppliers alike … These early-stage engagements are progressing well. … with early testing and technology assessment well underway and with multiple proofs of concept that are again underway.”

He explained that this process is quite different from a traditional sales cycle: “It’s really much more of a co-engineering motion with several phases to it. Technology assessment selection, some testing of that ultimately leading to a design win where that technology is chosen as kind of the plan of record and then progressive validation testing on the way to pilot and then eventually scaling to production.”

Lee also said that Pure was winning sales into the Neo cloud GPUaaS market: “We did have several wins with GPU-as-a-service providers, not just servicing their GPU directly-attached footprint, but as well some of their backup and data protection needs and VM and block needs.”

The company is guiding next quarter’s revenues to be $955 million +/- $5 million, up 15 percent at the mid-point. It’s increased its full fy2026 guidance from $3.515 billion to $3.615 billion +/- $15 million, a 14 percent Y/Y rise from fy2025.

Comment

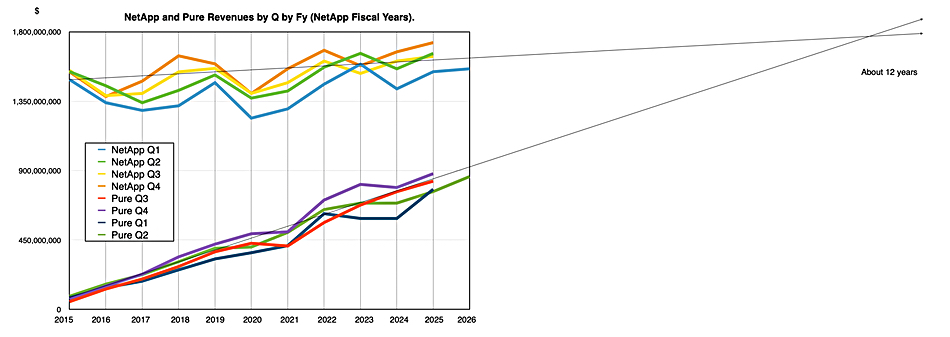

Pure’s quarterly results were better than NetApp’s, with that company’s low 1 percent revenue growth. We have charted the two company’s revenue numbers by quarter, by fiscal year, over the past few years, and then extrapolated the growth trend lines to give a sense of their indicative growth trajectories:

It’s obvious that any number of unanticipated events could disrupt this picture. It would also be highly interesting to understand how VC and founder-owned VAST Data’s all-flash-based storage and AI software revenues would appear in this picture. Our sense of storage industry hints and comments is that VAST’s quarterly revenues are growing in the mid-to high double-digit percent area and it might, we stress might, have surpassed $100 million in annual revenues. If or when it files for an IPO then we will see the real numbers.