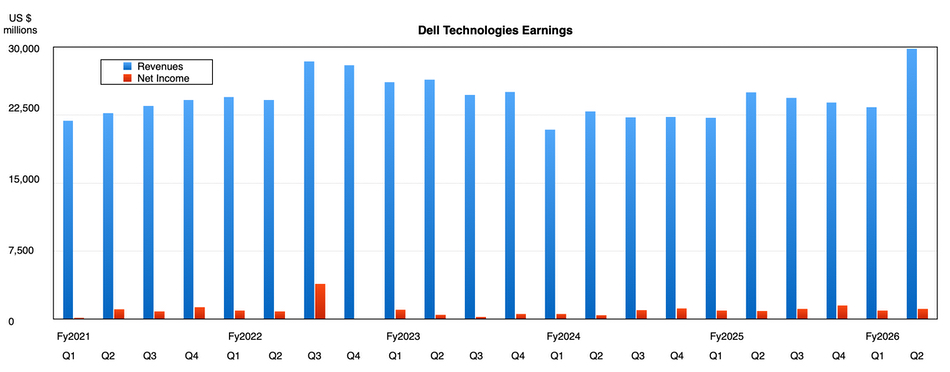

Dell’s quarterly revenues showed a 19 percent jump to a record $29.8 billion in its second fiscal 2026 quarter, as server and networking revenues, fueled by AI demand, rose an astonishing 69 percent, beating the $29.5 billion high-point of its guidance

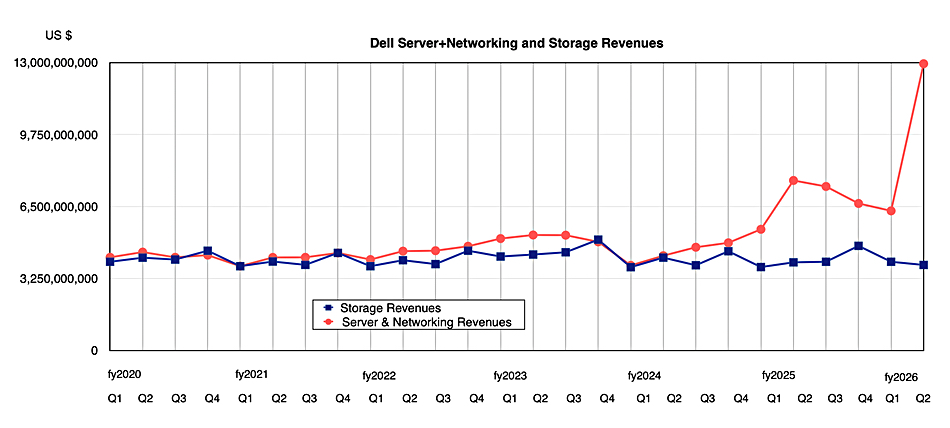

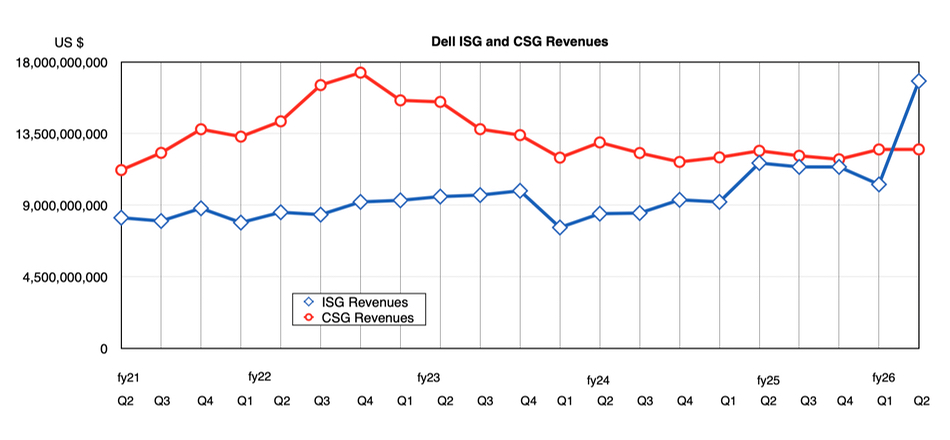

Overall Infrastructure Solutions Group (ISG) revenues rose 44 percent to $16.8 billion, overtaking Client Solutions Group (CSG) for the first time. Storage revenues declined year-on-year, as demand was softer than anticipated. The PC-focused CSG’s revenues rose a miserly 1 percent to $12.5 billion, again with no AI-acceleration in PC demand.

Vice-chairman and COO Jeff Clarke stated: “We’ve now shipped $10 billion of AI solutions in the first half of FY26, surpassing all shipments in FY25. This helped deliver another record revenue quarter in our Servers and Networking business, which grew 69 percent. Demand for our AI solutions continues to be exceptional, and we’re raising our AI server shipment guidance for FY26 to $20 billion dollars.”

There was an AI backlog of $11.7 billion exiting the quarter. Dell said its opportunity pipeline continued to grow sequentially and remains multiples of its backlog. Clarke said there was double digit growth across Enterprise and Sovereign AI opportunities.

Quarterly financial summary

- Gross margin: 18.3 percent vs 21.4 percent a year ago

- Operating cash flow: $2.5 billion vs $1.34 billion last year

- Free cash flow: $1.87 billion vs $704 million a year ago

- Cash, cash equivalents, and restricted cash: $8.29 billion vs $4.67 billion a year ago

- Diluted EPS: $1.70, up 38% Y/Y

To better appreciate its sudden increase, the rise in server sales, compared to the fall in storage sales, can be shown graphically;

Dell mentioned that, in its storage portfolio, demand for PowerStore, its all-flash, mid-range, dual-controller, unified file and block storage array, was up double digits Y/Y, growing for the sixth consecutive quarter, five of those up double digits, fueled by very strong Channel participation. Within PowerStore, 46 percent of the buyers were new PowerStore customers and 23 percent were new to Dell Storage.

Clarke said that, overall: ‘All-flash storage saw strong growth, driven by strength in our all-flash offerings across PowerMax, PowerStore, PowerScale, and ObjectScale.” Strong growth was defined as double-digits by Clarke in the earnings call. Thus there was low or negative growth in Dell’s disk-based and hybrid disk+flash storage products.

Overall, Clarke said, with “our Dell IP storage, we expect to outperform the marketplace. So the market is growing, and we expect to outgrow that market in the second half. It’s offset by HCI customers going through what I think is a rethink of their private cloud options.”That’s the effect of the VMware Broadcom upset.

Dell says IDC gives it the number 1 position in AI-centric storage, with a 26.9 percent share (per IDC Semiannual AI Infrastructure tracker 2024 H2 [Feb 2025]).

Sequentially the server and networking curve looks like a rocket taking off. The change in CSG and ISG revenue fortunes is also illustrated well in a chart;

Next quarter’s guidance is $27 billion in revenues, +/- $500 million, a 10.7 percent Y/Y rise. Dell anticipates CSG revenue growth in the mid single-digits and ISG growth in terms of low twenties.

Full fy2026 guidance, which was $102 billion +/- $2 billion, is now $107 billion +/- $2 billion; surging up by $5 billion.CSG revenue will grow in the low- to mid-single-digits. ISG revenue growth will be in the mid-to-high twenties with non-all-flash storage flat. For Dell, which says the AI hardware and services TAM is expected to double from $184 billion last year to $356 billion in 2028, AI must stand for “Accelerated Income.”

Comment

Both Dell and NetApp, with their hybrid disk and flash offerings, have reported lacklustre storage sales but all-flash storage shipper Pure Storage reported 13 percent growth in its storage sales. This correlates with Dell recording strong all-flash storage growth with double-digit Y/Y growth for its all-flash PowerStore, and also with NetApp reporting 5 percent Y/Y revenue growth for its AFAs. It bodes well for SSD manufacturers and suppliers, but not so well for disk drive suppliers.