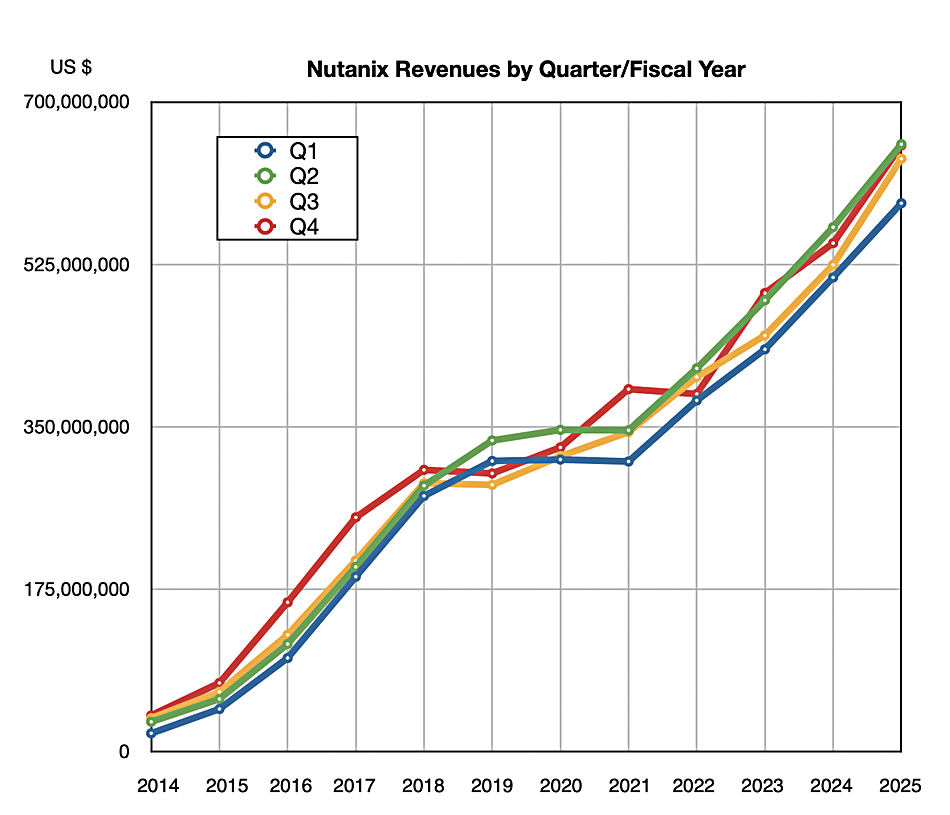

Nutanix beat its revenue guidance with an 18 percent year-on-year jump to $653.3 million revenues for its final fy2025 quarter.

GAAP net income rose enormously, turning the year-ago $126.1 million loss into a $38.7 million profit. Full fy2025 year revenues of $2.54 billion were also up 18 percent Y/Y and full year profits of $188.4 million more than reversed the previous year’s $124.8 million loss. Nutanix’ Board authorized an increase of $350 million of common stock to the company’s existing share repurchase program

Nutanix is firing on all its engine’s cylinders and CEO Rajiv Ramaswami reflected this in his comments: “Our fourth quarter was a good finish to a fiscal year in which we delivered high-teens top line growth and added over 2,700 new customers.”

CFO Rukmini Sivaraman added her take: “Our fiscal 2025 results demonstrated a good balance of top and bottom line performance with 18 percent year-over-year revenue growth and strong free cash flow generation. These results drove a Rule of 401 score of 48, our second year in a row above 40.” The Rule of 40 is that a SaaS business’ revenue growth rate plus its profit margin should be equal to or greater than 40 percent.

Its average contract duration rose to 3.2 years, up by 0.1 year. Average Recurring Revenue (ARR) rose 17 percent to $2.2 billion. The customer count rose by 800 to 29,290, the highest increase over the past 22 quarters. What’s more, it expects to continue landing new customers onto its platform at a rate of approximately mid-high three digits of new logos a quarter in fy2026, say around 600 a quarter. This will be helped by its Dell, Cisco, Pure Storage and AWS partnerships. It provides a steady infusion of cash as the vast majority of customers have licenses provisioned up front and also pay Nutanix multiple years of cash upfront on purchase. It’s quite a business model.

Nutanix’ gross margin rose to 87.2 percent from 85.2 percent last year and its free cash flow was 207.8 million vs $224.3 million a year ago. Cash, cash equivalents and short-term investments of $1.993 billion were up from $1.882 billion at the end of the prior quarter.

Nutanix says the market generally is exhibiting hybrid multi-cloud adoption, where it has a strong play, and also GenAI-influenced growth, where it also has offerings, such as GPT-in-a-Box. A third secular trend is the VMware diaspora caused by Broadcom’s VMware acquisition and subsequent upward cost revisions for licenses.

Ramaswami commented on this in the earnings call: ”I think the vast majority of the opportunity is still in front of us. And if you were to characterize this as a multi- inning baseball game, I’d probably say we’re in the second inning at this point. And there’s still a lot of customers out there with VMware and it’s going to take time in terms of these migrations. We are seeing – I mean, the fact that we’ve added 2,700 customers over the last year is a good sign that there are people moving. But there’s 200,000 customers out there for VMware.”

Nutanix’ market has five component areas: On-prem HCI, hybrid cloud infrastructure, cloud management, file and object storage, and database automation and database-as-a-service, making up its $76 billion total addressable market in calendar 2026.

The outlook for next quarter assumes 14.2 percent growth to $675 million (+/- $5 million) and the full fiscal 2026 guide is for $2.92 billion (+/- $20 million) which is 15.6 percent more than fiscal 2025. We can expect Nutanix to guide cautiously and hope for guidance-beating results. The watchwords here are under-promise and over-deliver.

Comment

Nutanix has deals with Dell (PowerFlex) and Pure Storage (Flash Array) whereby customers would hook up Nutanix server/hypervisor SW to Dell or Pure external storage arrays. There is a prospect we can discern here for more partnerships, with the storage supplier seeing new customer growth in the Nutanix market. Think HPE, Lenovo and NetApp.