NetApp eked out one percent growth in its first fy2026 quarter but it won the number one all-flash array market share position for calendar Q1 2025.

Revenues in the quarter ended on July 25, 2025 were $1.56 billion, with a GAAP profit of $233 million, down 6 percent Y/Y. The revenue was above the mid-point of its guidance range of $1.53 billion +/- $75 million.

CEO George Kurian accentuated the positive, stating: “We delivered a solid start to fiscal year 2026 as organizations are increasingly choosing NetApp to build future-proof AI-ready data infrastructure.” He mentioned that “robust performance in the Americas enterprise offset year-over-year declines in U.S. Public Sector and EMEA” in his prepared remarks.

He added this in the earnings call: “U.S. public sector was very weak in the quarter. I think we were still awaiting budgets to be deployed to agencies. We saw a change in the budgets allocated to different types of agencies, and we have moved resources to where the budgets are.” Overall: “The spots of weakness were localized, but pronounced in those areas.”

Quarterly financial summary

- Gross margin: 70.4% vs 71.3% a year ago

- Operating cash flow: Record $673 million vs year-ago $341 million

- Free cash flow: Record $620 million vs $640 million in prior quarter

- Cash, cash equivalents, and investments: $3.3 billion vs prior quarter’s $3.85 billion

- Diluted EPS: $1.15 v $1.17 a year ago

- Share repurchases and dividends: $404 million vs prior quarters $355 million

In Kurian’s view: “By helping customers modernize with cutting-edge and cyber resilient storage solutions, we have taken the lead position in the all-flash market. Our unique cloud services facilitate seamless hybrid and multicloud transformations, and we are well-positioned and growing in the emerging enterprise AI opportunity. I am confident in our ability to capitalize on this momentum and deliver sustainable long-term growth.”

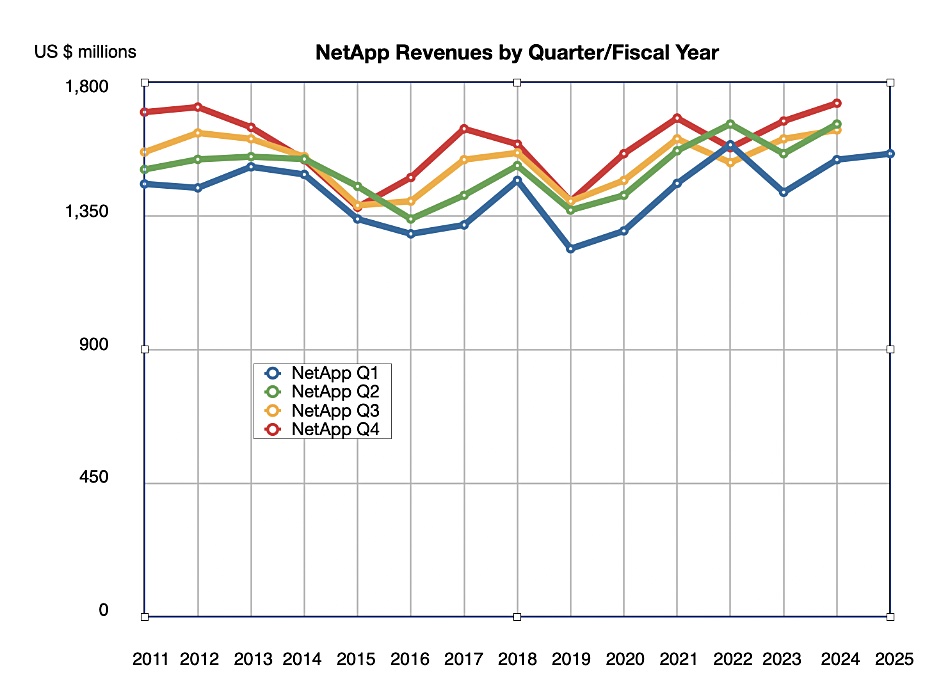

Sustainable long-term growth has eluded it in recent years, as a chart demonstrates;

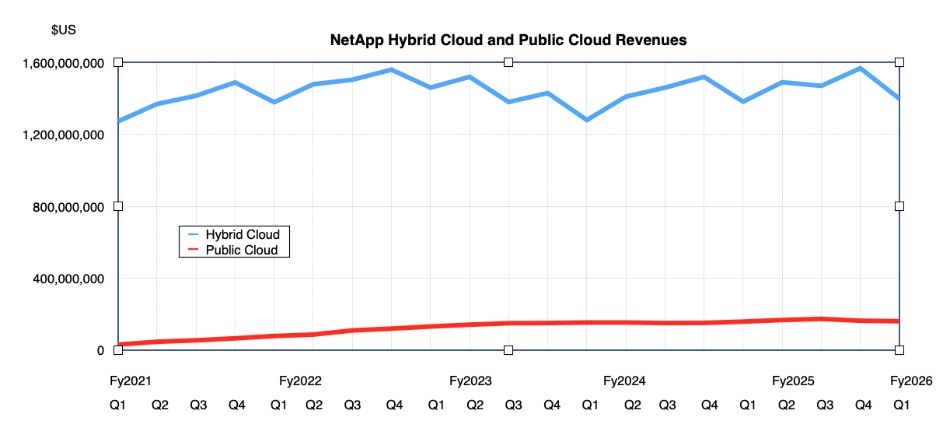

Its attempt to grow revenues by porting its ONTAP software to the public cloud in cloud-native form, and adding cloud management functionality, has been perfectly positioned, one would think, to capitalize on customer’s interests in both migrating to the public cloud or enjoying hybrid on-prem/public cloud IT. Kurian said: “Our highly differentiated first party and marketplace cloud storage services continue to deliver rapid growth, increasing 33 percent from Q1 a year ago. “ That’s encouraging but overall growth in its public cloud business has been low to non-existent, as a second chart indicates;

The AFA side of things is a success, particularly as Netapp is facing strong competition from Dell, HPE, Pure Storage and VAST Data. Kurian said: “Exiting Q1, 45 percent of systems in our installed base under active support contracts are all-flash. Healthy customer engagement and strong interest in our unified and block-optimized all-flash storage portfolio have enabled us to displace competitive all-flash and hybrid-flash footprints.” That means there is scope to sell more AFAs into its customer base and also outside it.

However, analyst Krish Sankar put his own spin on the flash numbers in the earnings call, asking CFO Wissam Jabre: “Your all-flash revenue growth has decelerated from double digits to just 5 percent now. Is it pricing or demand or something else?”

Jabre replied: ”We did experience some softness in the U.S. public sector and to a much lesser extent, EMEA. While it was offset by the Americas, that sort of drove the dynamics on seeing all-flash growing slightly lower than previous quarters, but this was already sort of anticipated by us. … We anticipate this to basically not continue for the rest of the year.”

AI demand has increased, Kurian saying: “We had north of 125 wins for AI in the quarter as compared to 50 a year ago.”

“The 3 types of use cases were data lakes, which was about 20 percent of the total number. There was training, which is either fine-tuning a large model or taking a smaller model and customizing it for your enterprise or building a sovereign cloud model for model training. We saw that was about 45 percent of the total number, and the remainder were RAG and Agentic AI use cases. For data lakes, it’s typically a combination of flash-based storage for the hot tables and hot data and a large archive with object storage. For the other 2, they are typically all-flash storage.”

He hinted that NetApp was making progress in the hyperscaler AI market with its cloud-based tools, and said NetApp was likely to introduce: “things that allow clients to actually manage their data more efficiently. This could be they want to be able to search the data, they want to organize it so that they can align certain data sets to certain volumes, to certain models and keep track of it. They want to implement guardrails and access controls. They want to automate the vectorization and the RAG readiness of their data. We have a lot of those capabilities coming at our [October] Insight conference.”

Jabre said NetApp is in a strong financial position: “We ended the quarter with $3.3 billion in cash and short-term investments and $2.5 billion in total debt, resulting in a net cash position of approximately $840 million.”

Next quarter’s outlook is for revenues of $1.64 billion +/- $25 million, a 1.2 percent decrease from a year ago at the mid-point; that’s depressing. The full fy2026 outlook is $6.75 billion +/- $125 million and a 2.7 percent increase on fy2025, so things do pick up.