Quinas Technology has completed a first step to volume production of its ULTRARAM universal computer memory combining the speed of DRAM, the non-volatility of NAND, and low energy consumption.

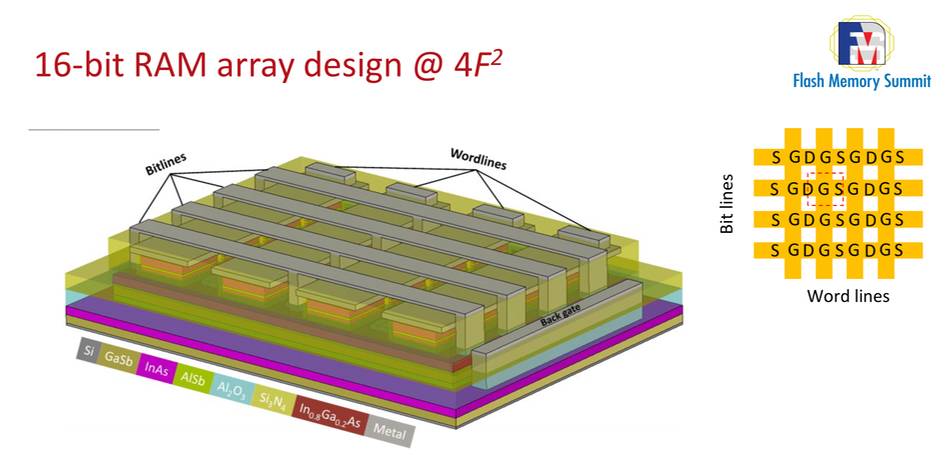

IQE plc scaled up compound semiconductor layers, first developed at Lancaster University by Quinas’s founders, to an industrial process. The year-long project developed advanced gallium antimonide and aluminum antimonide epitaxy, claimed as a world-first for scalable memory devices. Epitaxy is the process of growing a crystalline layer on a crystalline substrate in a regulated manner, with the deposition layer adopting the substrate’s crystal structure.

Jutta Meier, CEO of IQE, stated: “We have successfully achieved our goal of developing a scalable epitaxy process for ULTRARAM, a milestone towards industrial production of packaged chips. This project represents a unique opportunity to bring the next generation of compound semiconductor materials to life in the UK.”

IQE has developed a manufacturing method to grow ULTRARAM’s compound semiconductor (gallium antimonide and aluminum antimonide) structures, using epitaxy, on an industrial platform. Innovate UK provided grant funding.

Quinas CEO and co-founder James Ashforth-Pook flew the UK semiconductor sovereignty flag, saying: “This project marks a turning point in the journey from university research to commercial memory products. With IQE’s industrial capabilities and Innovate UK’s support, we have taken a critical step toward building sovereign capability in memory – the most strategically vital yet underrepresented segment of the UK semiconductor stack.

Quinas and IQE are now exploring further industrialization and pilot production with foundries and strategic collaborators.

Ashforth-Pook reckons: “ULTRARAM’s potential to radically improve energy efficiency in AI, mobile and datacenter applications positions Britain as a leader in next-generation memory innovation.”

If ULTRARAM replaced DRAM, which requires constant refreshing, that electricity use would be eliminated. Quinas says its smallest devices switch “at 100 ns at energies of <1 femtojoule, which is lower than any known memory device. As a candidate for ‘universal memory’, ULTRARAM has the potential to radically transform the entire digital technology landscape, from small autonomous Internet of Things (IoT) devices, through to smartphones, laptops and datacenters.”

Quinas won a 2025 World Intellectual Property Organization (WIPO) award in the ICT Start-Up category in July. The company holds five granted patents in four countries with another eight pending. Check out a detailed Quinas ULTRARAM presentation at the 2023 FMS convention here.

Comment

Quinas’s ULTRARAM is a disruptive technology that could replace DRAM and NAND. Consider the basic DRAM and NAND supply chain. DRAM manufacturers (Micron, Nanya, SK hynix, Samsung) and NAND fabricators (Kioxia, Micron, SK hynix/Solidigm, Samsung, Sandisk, YMTC) supply DRAM, NAND, and SSDs to end device suppliers of embedded, mobile, laptop, desktop and server processing systems. Quinas would need to enter this supply chain so that the end device suppliers would use its ULTRARAM instead of DRAM and NAND. This would require hardware, OS, and system-level software changes.

Were Quinas to partner with a DRAM and NAND supplier it would be able to use that organization’s credibility and supply chain contacts to present and provide its technology to end-device manufacturers, such as Dell, HPE, Lenovo, and so forth.

If Quinas decides to go it alone, then it has a much larger job on its hands and will need to focus on a small and manageable market area, such as embedded devices where it could work with the system software supplier.

If Quinas can (1) prove industrial-scale manufacturing at usable yields, and (2) show system-level performance far above DRAM+NAND at lower energy cost, then ULTRARAM could go places. But – and this is the big but that prevented Optane reaching its potential and is confining MRAM, ReRAM, and other emerging memories to niche market status – it absolutely has to show a road to profitable manufacturing at scale.

Bootnote

We hear that Quinas seems like they are about 8 years from production IF everything turns out well. If not then it’s probably more like 10-15 years.