Sandisk recovered from its poor previous quarter with a 12 percent sequential revenue rise as NAND undersupply enabled it to raise prices.

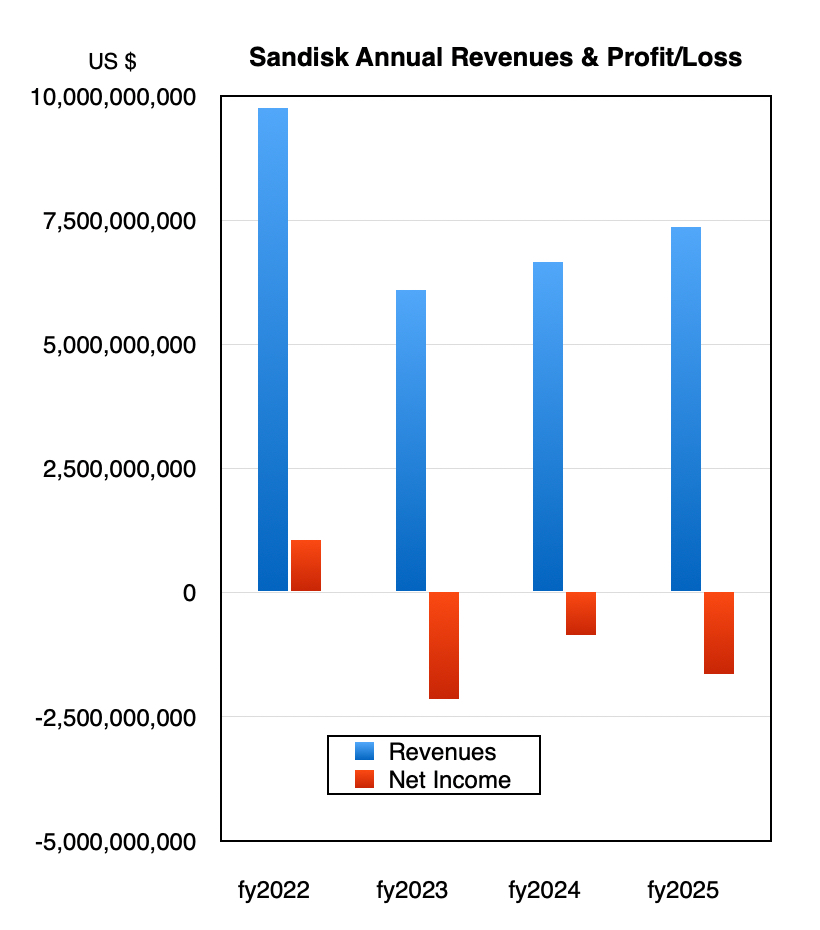

Revenues in the final fiscal 2025 quarter, ended June 27, were $1.9 billion, a 7.9 percent year-on-year increase and beating its $1.85 billion guidance, with a GAAP loss of $23 million; quite a switch around from the year-ago $120 million profit. A transition to a new NAND node, BiCS8, has caused high start-up costs in the joint-venture fabs operated with Kioxia. Full FY fy2025 revenues were $7.36 billion, 10 percent higher than the prior year, with a GAAP loss of $1.6 billion, almost double the year-ago $96 million loss.

CEO David Goeckeler stated: “Sandisk delivered strong results this quarter, with revenue and non-GAAP EPS exceeding our guidance.” Looking ahead he said: ”With High Bandwidth Flash (HBF), we are creating a new paradigm for AI inference solutions. With demand improving and industry fundamentals strengthening, we are well-positioned to drive sustainable growth, expand margins, and generate strong cash flow.”

HBF is the use of high-bandwidth memory type die stacking and multi-channel interposer links to an on-package GPU to provide a high-speed NAND cache to offload the GPU’s memory. Goeckeler noted: “This is a technology that can play from the edge, so PCs, smartphones, all the way into the cloud. …We think it’s a new paradigm for how [AI] inference is driven.”

He is envisaging a smartphone’s processor having both DRAM and HBF attached to it.

Webush analyst Matt Bryson commented: “With consensus anticipating an even steeper improvement (going back to Sandisk’s initial comments during its analyst day before tariffs and tariff uncertainty took a bite out of the expected market), numbers ended up disappointing vs. expectations with the stock falling ~10 percent.”

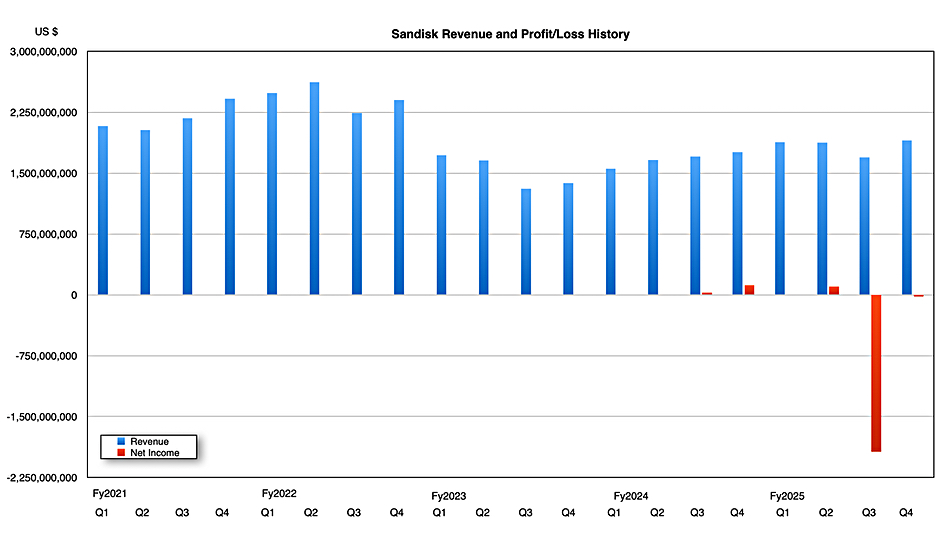

Let’s look at its quarterly revenue history;

The revenue numbers from FY 2021 onwards, when Sandisk was part of Western Digital, shows a peak in the second fiscal 2022 quarter followed by a slump to the third FY 2023 quarter and then a gradual climb until growth flattened in Q1 to Q2 FY 2025 and went negative in the third quarter after the spin-off from Western Digital. That dip has been reversed; Goeckeler commented that “overall demand exceeded supply” in the earnings call. This enabled prices to rise.

CFO Louis Visoso said “bit shipments and average selling prices were up mid single digits” sequentially. The revenue growth was helped by price increases, particularly in the client area, with more increases coming, and the guidance beat was due to “better than expected bits growth.”

The company has laid off approximately 200 employees, which follows the revenue dip in the previous quarter.

Financial summary

- Gross margin: 36.4 percent vs year-ago 26.4 percent

- Operating cash flow: $94 million vs year-ago $94 million

- Free cash flow: $77 million vs year-ago -$130 million

- Cash & cash equivalents: $1.5 billion vs $328 million a year ago

- Diluted EPS: $0.29

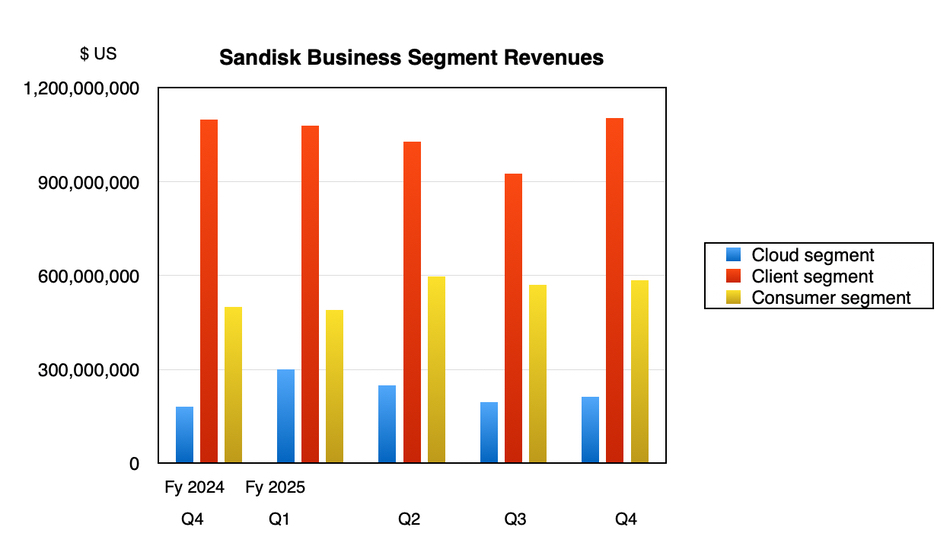

Sandisk, which became independent from Western Digital in February, makes NAND chips in a fab joint-venture with Kioxia, and builds them into SSDs which it sells into three business segments: Cloud (hyperscalers and enterprise data centers), client (PCs, notebooks, mobile, automotive), and consumer (retail), representing 11.2, 58, and 30.8 percent of overall revenues respectively. It’s an unbalanced business from that point of view. The segment revenues were:

- Cloud: $213 million, up around 18 percent Y/Y and 8 percent Q/Q

- Client: $1.1 billion, flat Y/Y, up 19 percent Q/Q

- Consumer: $585 million, up about 17 percent Y/Y, 2 percent Q/Q

It’s using its main BiCS6 (162-layer) NAND for data center and client drives, transitioning to newer BiCS8 (218-layer) with startup costs, and making consumer drives with older BiCS5 112-layer product. The layer count, or node, transitions brings down the cost/GB and enables Sandisk to earn more revenue from selling the same amount of capacity. The transitions take time, with Goeckeler saying that, in: “Q4, …about 7 percent of our bids were BiCS8, and we will be somewhere between 40 – 50 percent by the end of fiscal year 2026.”

Sandisk says it has “strategic positioning for growth in data center in compute and storage solutions” where the surge in demand for AI processing is driving demand for high-capacity and high-performance SSD storage. The company saw “Clear momentum with customers in AI-driven workloads and hyperscale demand” with “explosive growth in AI and cloud infrastructure build-outs.“ It has announced a 256 TB UltraQLC drive and is “advancing customer qualifications for compute and storage eSSDs, including with NVIDIA GB300 and multiple hyperscalers.”

There is scope here for it to grow its cloud revenues substantially. Goeckeler commented: “data center represented over 12 percent of our total bits shipped, a meaningful milestone as we scale in this critical part of the market.” Progress will not be that quick, with Goeckeler saying: “Expansion into the data center space requires sustained effort given its long qualification cycles.”

The plan: “is to qualify our high capacity Ultra QLC platform at several major Tier one customers by the end of fiscal year 2026. On the compute enterprise SSD front, we are encouraged by the progress we have made in qualifying solutions with key customers, including an ongoing qualification with the second major hyperscaler and other customers using the Nvidia GB300.”

Next quarter’s guidance envisages revenues of $2.15 billion +/- $50 million, a 14 percent uplift at the mid-point on the year-ago quarter’s $1.9 billion. Visoso said: “We expect revenue growth to come from bits growth and higher average selling prices with similar contributions from both drivers.”

Goeckeler’s view is that: “As we enter fiscal year ‘twenty six, we see momentum in our product portfolio, an improving supply and demand environment and early benefits from our pricing actions.” Sandisk is seeing very low double-digits bit demand growth with supply under that, keeping prices higher than otherwise. It sees the under-supplied market continuing through 2026.

He noted that the tariff situation is evolving dynamically: “It’s something you got to stay very close to on a day to day basis and tariffs are another thing that are part of that equation. We stay very close to that.” Overall: “We’re very confident in our ability to navigate this whole situation with our global footprint.”

HBF Bootnote

Goeckeler said: “We’ve got a controller to design and all the interfaces to standardize around that. And doing it with an industry partner [SK hynix], we think, is the right way to go to move this along drive adoption as quickly as possible. …we think the industry is going to need this kind of capacity in the memory architecture to drive inference at scale.”

On timing: “Next year we’ll be sampling the die for the NAND and then early 2027 we’ll have the controller that goes along with that.”

HBM has driven SK hynix revenues extraordinarly high. If HBF becames a standard fit for AI-capable processors in a whole range of devices, from hand-held through embedded to desktop and servers, then it could potentially drive Sandisk revenues to similar heights.