GigaOm has released a second edition of its Globally Distributed File Systems Radar report combining players from the cloud file services, data orchestration and fabric-based scale-out filer markets, with VAST Data leading CTERA and NetApp

The report, by analyst Chester Conforte, includes and rates eight suppliers: CTERA, Hammerspace, LucidLink, Nasuni, NetApp, Panzura, Qumulo and VAST Data. CTERA, LucidLink, Nasuni, and Panzura sell into the cloud file services market offering real-time file sharing to organizations with distributed offices and users. Hammerspace is the sole data orchestration supplier, now having a strong focus on enabling distributed data to be fed fast to GPUs for AI workloads. NetApp and Qumulo bot have on-premises-public cloud data fabrics for their filers; scale-up and clustered in NetApp’s case, and scale-out for Qumulo. VAST Data provides a parallel scale-out file and data access system using standard NFS instead of a parallel file system and has a total focus on AI with its AI OS software stack.

Our point is that we don’t see how a single purchaser looking for either a cloud file services, AI-focussed data orchestration, public-private hybrid filer or a comprehensive AI-oriented, multi-protocol AI development, operation and storage system would group all these suppliers together.

Still, GigaOm’s analyst has done that, and rated the suppliers in terms of their market positioning and and value to buyers using three variably-weighted measurement dimensions, classifying them as entrants, challengers and leaders, and plotting their position on a quasi-radar screen. (We explained how this was done here.)

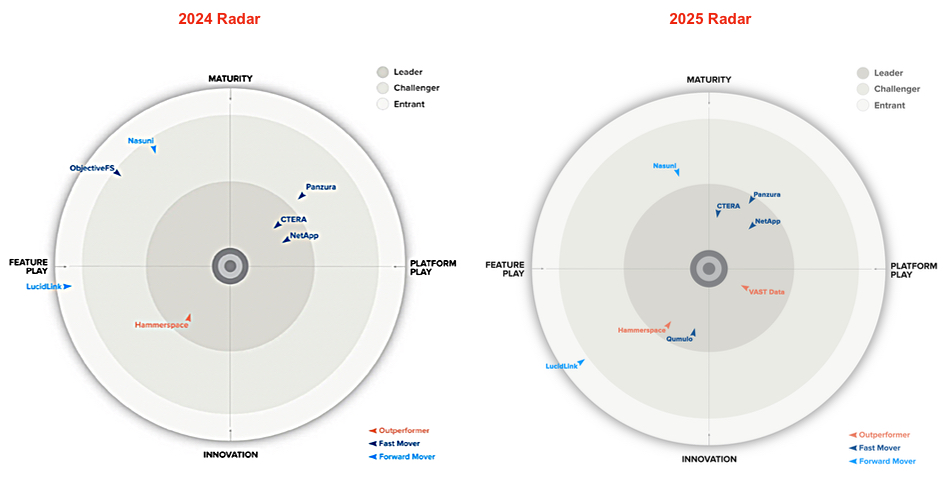

We show the latest distributed file systems radar diagram below with last year’s Radar on its left for comparison;

We immediately see ObjectiveFS has been ejected from the group of rated suppliers, and both Qumulo and VAST Data have entered the group. As before, LucidLink, which sells only to MSPs, is classed as a lowly Entrant. Nasuni is the single Challenger, but has moved significantly closer to the Leaders’ area. Previous Challenger Panzura is now a Leader along with the other suppliers.

Three suppliers are classed as innovative feature players: Hammerspace, Qumulo and Lucid Link. VAST Data is the sole occupant of the innovative platform player’s quadrant with Nasuni matching its status in the feature play/maturity players’ quadrant. CTERA, NetApp amd Panzura are grouped together in the platform play/maturity area.

In terms of closeness to the center, meaning having the highest overall business value, VAST Data is numero uno, CTERA and NetApp pretty much being joint second and Qumulo fourth, followed by Hammerspace and then Panzura.

The entire GigaOm report can be read via a CTERA link.

Frost & Sullivan award

CTERA has also picked up a Frost & Sullivan award as its 2025 Global Company of the Year in the Hybrid Cloud Storage market for the strength of its global file system platform, its security capabilities, and its commitment to launching innovative product enhancements and creating a growth-oriented business.

Karyn Price, Industry Principal, ICT at Frost & Sullivan, said: “CTERA’s platform optimizes file storage and transfer in complex, multi-cloud environments. CTERA Direct, a service within the platform, enhances file transfer speeds via its ultra-fast, edge-to-cloud file transfer protocol, which provides fast movement of data for data-heavy workloads,” said Karyn Price, Industry Principal, ICT, Frost & Sullivan. “Perhaps most compelling is the military-grade security capabilities that CTERA offers to its customers. The CTERA platform provides native data protection and restoration capabilities, enabling customers to eliminate separate data protection services if they choose.”

That must be music to the ears of CTERA’s workforce.

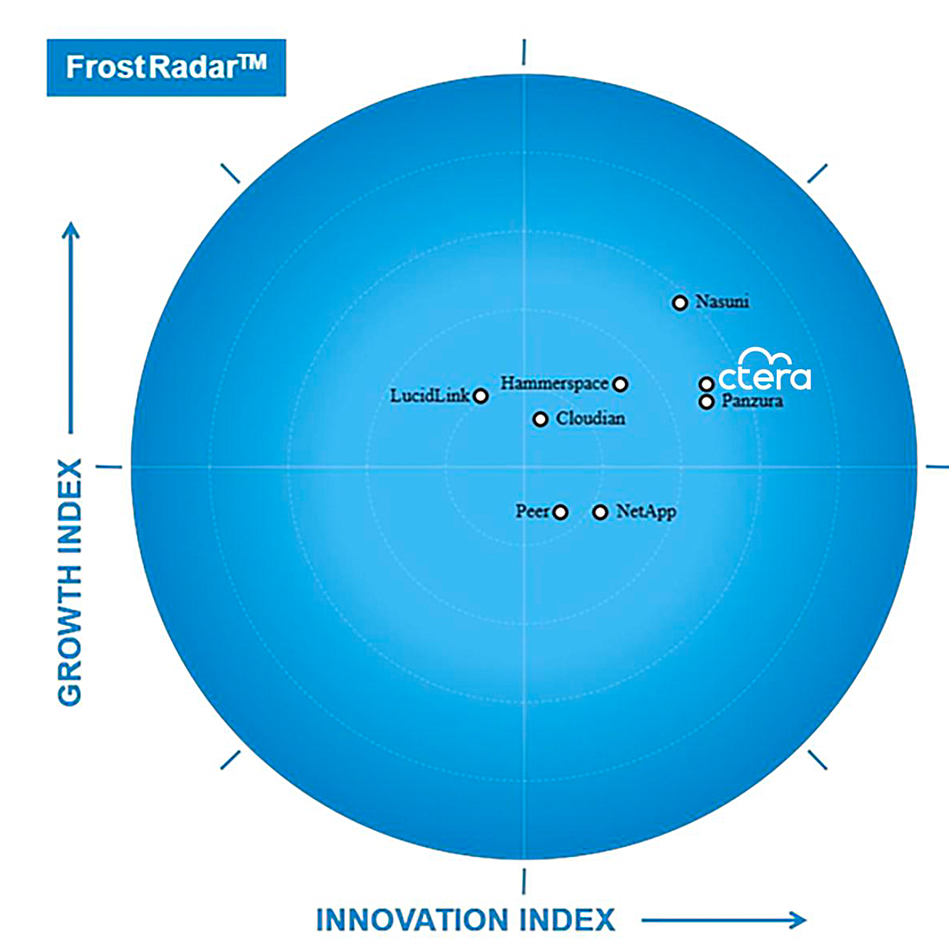

There is an accompanying diagram, another quasi radar screen, with a different layout and organization from that used by GigaOm. Read Frost & Sullivan interpretation notes here. The further away from the center the better a company is doing. This is completely the opposite of the rating depiction in GigaOm’s Radar where the closer you are to the center the better. Different analyst, different rules.

Frost & Sullivan’s radar screen shows that CTERA is in a group along with Cloudian, Peer, LucidLink, NetApp, Hammerspace, Panzura and Nasuni. But not VAST Data nor Qumulo. Different analyst, etc.

Nasuni is the overall leader, followed by CTERA and then, closely, by Panzura.

The Frost & Sullivan CTERA award document can be viewed here.