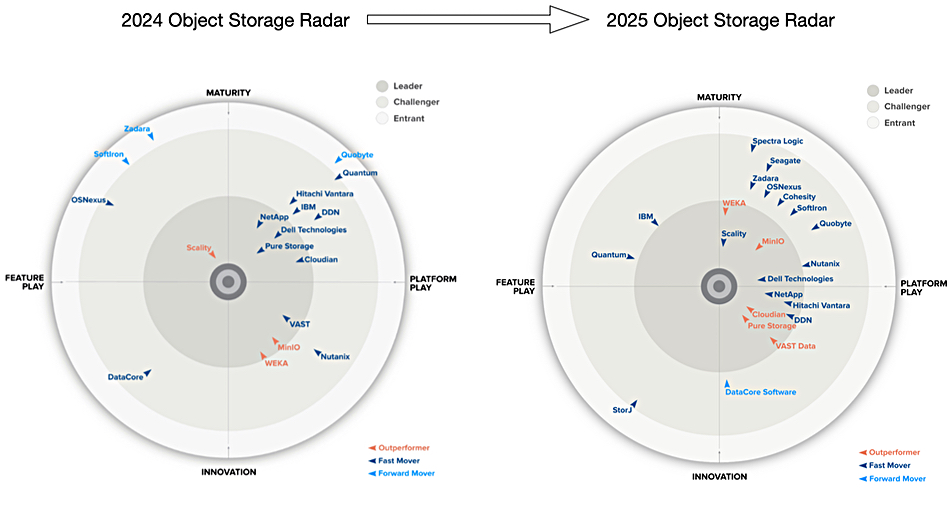

Research house GigaOm’s 2025 Object Storage Radar report identifies 22 suppliers, up from last year’s 18, with some dramatic changes in their status as the market shifts towards products with generic market appeal.

Analyst Whit Walters says; “The key characteristics of enterprise object stores have changed, with more attention paid to performance, ease of deployment, security, federation capabilities, and multi tenancy.” This is against a background of the volume and variety of data continuing to grow exponentially.

He identifies 10 leaders in this 6th edition of the report, which compares to 8 last year; DDN and Hitachi Vantara having been promoted into the leaders’ category from last year’s Challengers’ status. Walters sees a market where the suppliers are increasingly mature and focussed on building general platform-focus products rather than niche market area offerings.

Here is the 2025 chart with the 2024 chart included for reference;

We can see several suppliers have crossed the chart from 2024 to 2025; IBM moves from the Mature-Platform quadrant to the Mature-Feature Play quadrant. WEKA moves from the Innovation-Feature Play to the Mature-Feature Play quadrant. Hitachi Vantara changes from last year’s Mature-Patform Play challenger to this year’s Innovative-Platform Play leader. All of last year’s entrants become challengers this year: Quantum, Quobyte, SoftIron and Zadara. There are also four new suppliers: Cohesity, Seagate, SoftIron and Spectra Logic.

As there is no distance-from-the-center number we have ranked the leaders in distance-from the center terms visually: Cloudian, Pure Storage, Dell, Scality, NetApp, MinIO, Hitachi Vantara, VAST Data, WEKA, and DDN in that order.

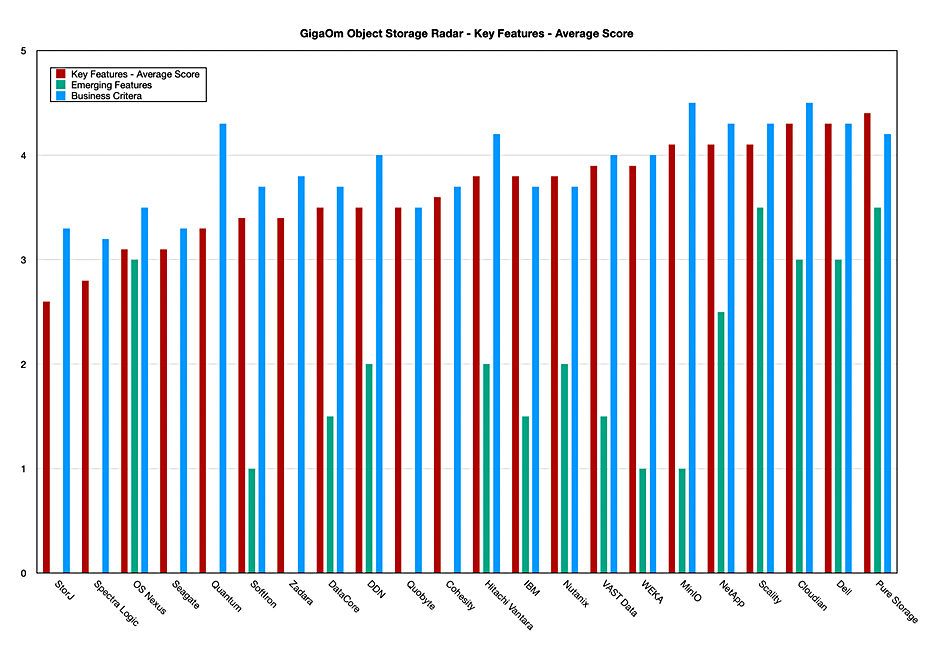

To produce the chart, suppliers are rated, with a zero to five score, on three dimensions: key features, emerging features, and business criteria. They each have sub-categories. These ratings contribute to a supplier’s position in the Radar diagram which “plots vendor solutions across a series of concentric rings with those set closer to the center judged to be of higher overall value. The chart characterizes each vendor on two axes—balancing Maturity versus Innovation and Feature Play versus Platform Play—while providing an arrowhead that projects each solution’s evolution over the coming 12 to 18 months.” The arrowheads indicate forward (normal), fast (quicker) and out-performers.

Walters says about the radar chart positioning: “Key features, emerging features, and business criteria are scored and weighted. Key features and business criteria receive the highest weighting and have the most impact on vendor positioning on the Radar graphic. Emerging features receive a lower weighting and have a lower impact on vendor positioning on the Radar graphic. The resulting chart is a forward-looking perspective on all the vendors in this report, based on their products’ technical capabilities and roadmaps.”

We charted each supplier’s rating for the three dimensions, ranked by key features score;

We should note that: “The Radar is technology-focused, and business considerations such as vendor market share, customer share, spend, recency or longevity in the market, and so on are not considered in our evaluations. As such, these factors do not impact scoring and positioning on the Radar graphic.”

Walters points out: “The majority of evaluated vendors are positioned within the Platform Play hemisphere (with an emphasis on the Maturity quadrant), while a few exceptions appear on the Feature Play side. This distribution indicates that most vendors prioritize stability and reliable user experience while offering comprehensive platform solutions.”

He adds: “Vendors are expanding their solutions to address a wider range of requirements, integrating functionalities beyond core object storage. This expansion reflects the demand for unified storage platforms that simplify data management across diverse workloads.”

Three vendors did not respond to Walters’ inquiries and their ratings are based on desk research, meaning their published documentation and webpages. These vendors were Cohesity (SmartFiles), IBM (Cloud Object Storage), and Spectra Logic (BlackPearl S3 Hybrid Object Storage).

Hitachi Vantara has kindly made the whole Radar report available via its website.