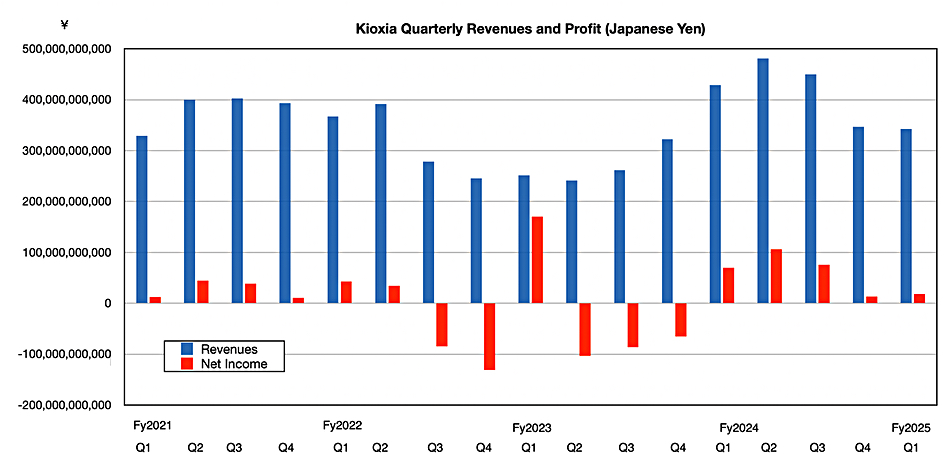

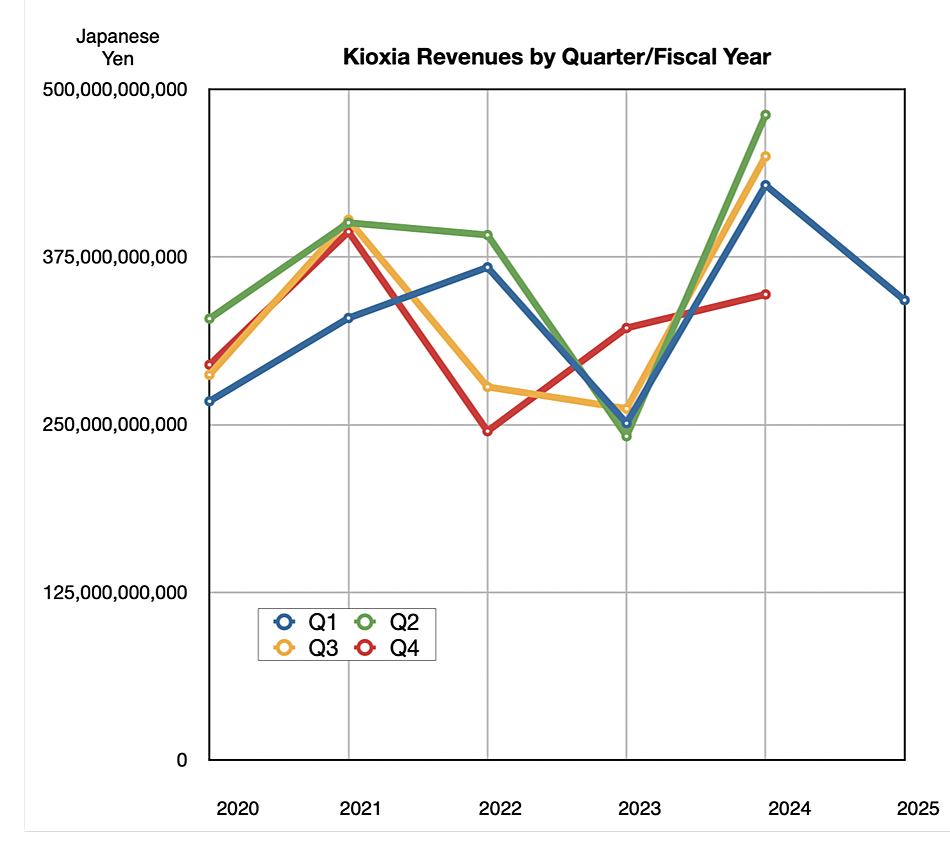

The hoped for AI uplift of SSD revenues can’t come soon enough for Kioxia which reported another consecutive down quarter, but there are encouraging signs in the revenue weeds.

Revenues in its first fiscal 2025 quarter, ended June 30, were ¥32.8 billion ($2.36 billion), substantially beating its ¥310 billion ($2 billion) guidance, although down 20 percent year-on-year, but just 1.2 percent down Q/Q, indicating the revenue drop rate is slowing significantly. There was a profit of ¥18.5 billion ($127.6 million), down 73.5 percent annually.

CFO Hideki Hanazawa stated: ”The first quarter results exceeded the upper end of guidance, mainly due to increased ASPS and some exchange rate effects. …We are seeing clear signs of recovery from the downward trend that we saw between the third and fourth quarters of fiscal year 2024.”

Financial summary:

- Free cash flow: ¥27 billion ($186.2 million) vs ¥64.1 billion ($427 million) a year ago.

- Cash & cash equivalents: ¥178.4 billion ($1.23 billion) vs year-ago ¥187.6 billion

- EPS: ¥24.6 ($0.159)

Kioxia said it’s been cash flow-positive for 6 consecutive quarters.

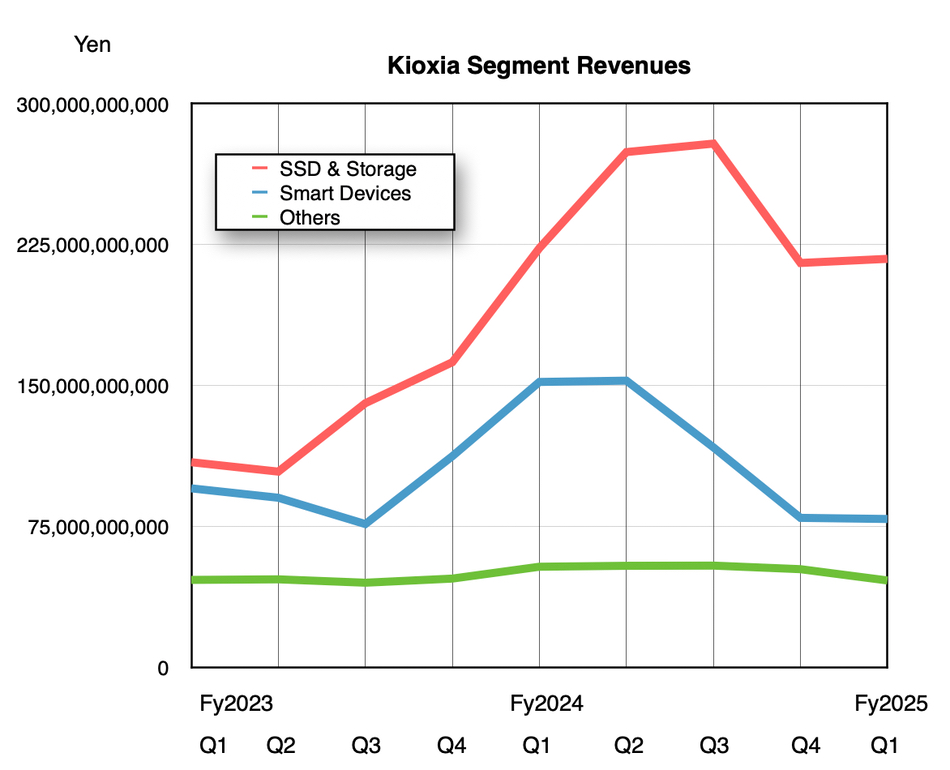

It earns revenue from three business segments, and their revenues were;

- SSD and storage: ¥217.4 billion ($1.5 billion) down 2.5 percent Y/Y, though up 1 percent Q/Q

- Smart devices: ¥79 billion ($544.9 million) down 48 percent Y/Y, down 0.7 percent Q/Q

- Others: ¥46.3 billion ($319.3 million) down 13.5 percent Y/Y, down 11.4 percent Q/Q

The SSD and storage revenues are split pretty much 50:50 between data center (DC) and enterprise sales on the one hand and PC sales on the other. DC/enterprise sales were flat sequentially. Although demand held up due to AI adoption, there were lower selling prices. PC sales increased sequentially as due to what Kioxia described as “partial pull-in demand.”

Smart device sales were flat Q/Q as, although customers started buying due to stopping inventory digestion, the transition to BiCS gen 8 218-layer flash started and it reduced demand for BiCS 5 112-layer flash.

The Others category covers sales to consumers of SD memory cards and revenue recorded through sales to Sandisk via the NAND fab joint-venture. The overall Others revenue level was down and bleak.

Trumpian tariffs have had a negligible effect thus far.

Kioxia’s guidance for the second quarter is ¥445 billion +/- ¥25 billion ($3 billion +/- $172 million). This is based on strong demand for data center and enterprise SSDs, driven by AI servers. It reckons that the PC and smartphone makers face growing demand for AI models and their inventories aren’t sufficient to meet that demand. Kioxia also expects the transition from its BiCS gen 5 to gen 8 NAND to result in a substantial increase in bit shipments.

Kioia said it is investing in equipment for its BiCS 10 332-layer flash, but that will be a 2026 shipment story.

Wedbush analyst Matt Bryson told subscribers that he is seeing a better outlook consistent with “recent reports/guidance from Hynix, Samsung, and Kioxia which have all highlighted better bit shipments (and bit shipment expectations) as well as improving pricing trends into Q3 (which we see as driven by improved cloud and AI demand).”

NAND, SSD and DRAM maker Micron raised its next quarter’s guidance today as well. It previously provided guidance for revenue of $10.7 billion ± $300 million, but now expects revenue of $11.2 billion ± $100 million. This is mostly down to better DRAM pricing.